Five emerging trends affecting the construction industry

updated on 02 March 2021

Question

What are five key trends, emerging during the covid-19 pandemic, that will continue to impact the future of the construction industry?Answer

The construction industry is one of the world’s largest sectors and is of key strategic importance to the UK economy. Not only is it a major employer and driver of economic growth across the UK, but it also sits at the heart of the government’s plans to future-proof and revive the economy post-pandemic.

Against this background, here are five emerging trends that will impact the construction industry both now and in future.

1. Insolvency and termination – Insolvencies are common in the construction industry. According to the Insolvency Service’s statistics, the industry had the highest number of insolvencies in the 12 months ending in March 2020. It is also one of the first industries to be hit when there is an economic downtown. The law on insolvency is therefore of considerable importance to the industry.

The Corporate, Insolvency and Governance Act 2020 (the Act) came into effect on 26 June 2020. It is described as the biggest shakeup to the UK’s insolvency framework in a generation. The Act’s primary objective is to provide businesses with the breathing space they need to continue trading during the covid-19 pandemic. It does so by stopping a supplier terminating a contract for the sale of goods or services solely because the other party has become insolvent (subject to certain exceptions). This is a permanent change that will have

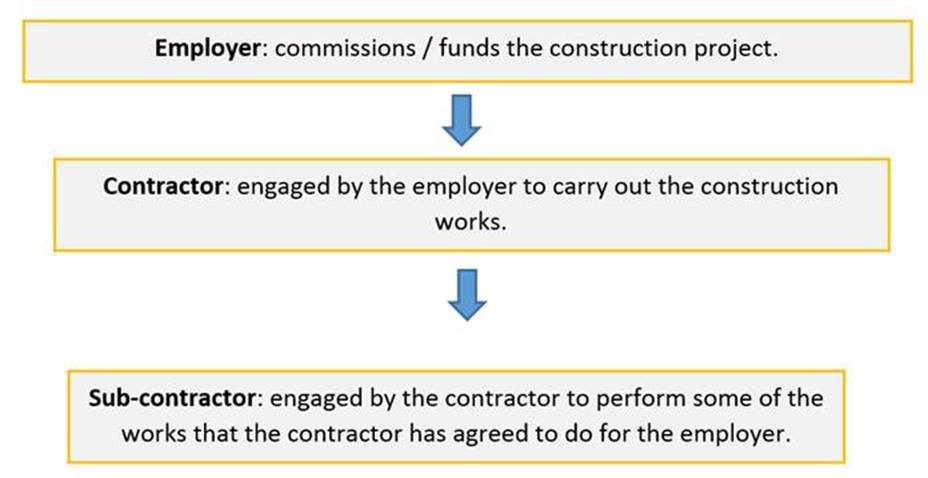

By way of background, the construction supply chain, in its simplest form, looks like this:

The contractor (supplying services to the employer) and sub-contractor (supplying services to the contractor) are therefore the suppliers in a simplified construction project.

2. Distribution centres – Our shopping habits have changed with remarkable speed. Before the pandemic many of us turned to internet shopping and decided we quite like it, turning the UK into the largest online shopping market in Europe and the third largest worldwide. The pandemic has further accelerated this shift. Many more shoppers have moved online to purchase goods for the first time in new categories, particularly from supermarkets and homeware goods retailers. Much of this rise in internet shopping is expected to become permanent. If so, more distribution centres – so-called ‘mega sheds’ that are well integrated into logistical networks – will be required.

Retailers increasingly value large distribution centres, close to urban areas, to stockpile goods and serve e-commerce consumers quickly and cost-effectively. Having the space to stockpile goods will be equally important post-pandemic, as UK companies continue to shift supply chains from a ‘just in time’ to a ‘just in case’ model to minimise Brexit-related risks. As such, the design and construction of large distribution centres to service the growing e-commerce sector will be a key revenue generator in the construction industry for years to come.

3. Modular construction – This method of construction, often generally described as modern methods of construction, involves constructing standardised building components off-site and assembling them at the building site, thereby shifting construction away from traditional building sites into off-site factories. The off-site construction sector was expanding rapidly before covid-19 – viewed by many, as an efficient, space-saving, speedy and cost-effective alternative to traditional building methods – and the virus has brought it into focus even more. Demand for modular construction is set to grow, both during and after the pandemic because it is:

- considered easier to socially distance when constructing and installing modular buildings rather than working on a traditional building site;

- offers quicker build times that will help, for instance, to regenerate NHS facilities and combat the UK’s chronic housing shortage; and

- more eco-friendly and also possibly easier to keep things clean/sterile while constructing.

4. Delay – Restrictions introduced to manage the pandemic have led to a big change for the way construction sites work. There have been (and continue to be) delays to on-site construction works as a result of contractors complying with the government’s new health and safety measures, including managing outbreaks on site, local lockdowns and site shutdowns. Responsibility for the time and cost of delay is currently a key area of dispute between parties.

5. Cladding – While this is not covid-19-related, it is still a trend. The government is intent on ensuring that high-rise buildings are safe and made it very clear that work to remove unsafe cladding should continue during the lockdown in March, April and May this year.

In December 2018, the government banned the use of combustible cladding materials on all new residential buildings over 18 metres high. It recently consulted on whether it should extend this ban to all new residential Coming into force on 26 November 2020 is a requirement that sprinklers be installed in the flats themselves on residential buildings between 11 and 30 metres in height.

The government has also published its Building Safety Bill in July 2020 where changes include placing greater duties on those responsible for designing and constructing ‘higher-risk buildings’ – likely to be defined as residential buildings that are more than 18 metres high. At the same time as the publication of this Bill, the government launched a consultation on amendments to legislation regulating fire-safety in non-domestic premises. This includes making it easier to identify the person responsible for fire risk assessments, increasing the quality of such assessments and regularly monitoring critical fire safety equipment.

In part due to these actual and proposed legislative changes, disputes remain as to who pays for removing and replacing combustible materials such as aluminium composite material (ACM) panels and insulation within external wall systems. In March 2020, the government announced that it would commit an additional £1 billion in funding to speed up cladding remedial works for high-rise residential buildings with combustible non-ACM cladding (estimated to be around 1,700 buildings). This was in addition to the £600 million already allocated to remediate the highest-risk ACM cladding. Given that, it is expected that the government’s funding will cover only around one-third of high-rise buildings with combustible cladding materials, we can expect to hear more about this in future. In the meantime, disputes will continue with building owners and lease holders seeking to recover the cost of remedial works from those building contractors and consultants responsible for selecting materials that are combustible and in addition relevant insurers and warranty providers.

Jastinder Samra is an associate at Mills & Reeve. Jastinder is based in the Birmingham office on the construction team.